What Made the Temenos Share Price Catch My Interest

The narrative started like many others with a coffee date and the scent of cinnamon wafting in the air. A friend of mine who enjoys reading financial reports in his spare time brought up Temenos. The name rang a bell. I had connections with the name but had never truly followed the company.

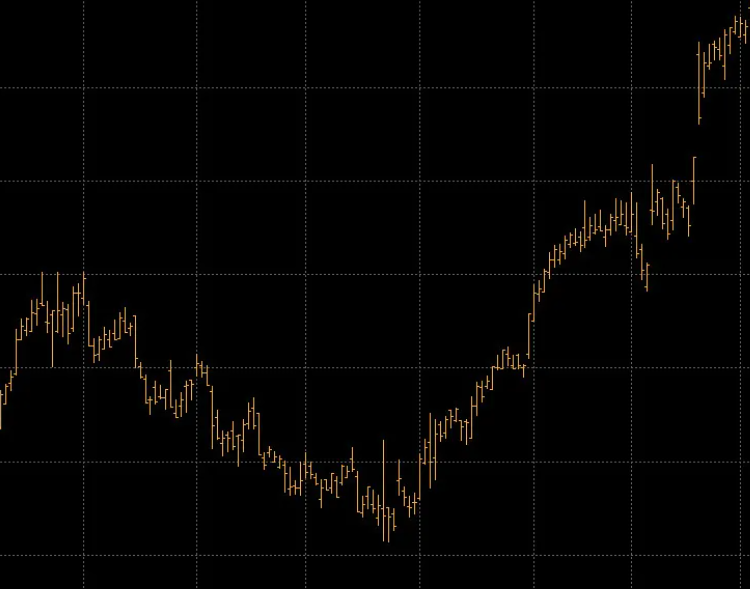

He had tapped something on his phone and, turning the device to face me, revealed a jagged little graph. “Look at this,” he said, evoking a balance of curiosity and mischief only market-watchers have. “This isn’t just about finance. There’s a story hiding in here.”

He was correct. The Temenos share price isn’t some lifeless number. It’s a reflection of the changes in global banking, investor sentiment, and, at times, seemingly unrelated occurrences that require some digging to connect. Following it taught me that share prices aren’t just for traders. They’re like diaries of the industries they represent.

Understanding Temenos: Not Just a Name

Let’s first look at the company itself before we jump into the price talk.

Temenos, a Swiss firm, develops the kind of banking software that the public does not see but relies on. It operates behind the screens of banks, performing tasks like processing transactions, account management, and preventing the digital systems from collapsing on a Monday morning. Not glamorous, but essential.

Being at the center of the intricate web known as global banking, the Temenos share price is a reflection of the share price trends around the globe. A shift in interest rates, the introduction of a new technology, a regulation, or a shift in the already existing political relations in a country, temenos share is bound to reflect it. To understand the share price movements, one has to take a look at the macro global banking landscape.

Analysts classify Temenos with the other Banking Technology Companies.

Most analysts would place Temenos in the “banking tech” segment, with the oversaturated fintech marketplace and the sluggish established banking institutions. However, Temenos as a company does not fully fit into either of the categories. Given the fact that the large banking institutions trust Temenos, it does put Temenos in the established category, but their ability to adapt to changing technologies and their preference to adopt innovation mark them as agile and adaptable, unlike sluggish established players.

This stability is exactly what surprises a large number of market watchers at times. One quarter, Temenos’s share price might surge because of one of Temenos’s massive client contracts. And the other quarter, or the other temenos stock price, is bound to take a hit because of a large global market fall.

What factors have caused Temenos Stock to shift in price?

If anything, the stock price temenos holds, and its movements do not reflect the current share price of Temenos Bank. Rather, it is a reflection of the market. Temenos Share Price First Temenos stock is bound to hit a low because of its huge client, and in the following quarter, it’s bound to hit a low. Temenos has signed on to other Temenos stock. Stock price matters become interesting when the Temenos stock tends to hit a low. In a situation like this, temenos market sentiments come into place.

What had caused the temenos stock price to go low

Not all influences have that extrapolative tendency. As a stark dépenses of as mentioned above, contracts spanning over temenos span over a quarter have been laden with highly positive affirmation during the temenos base meeting, which as a whole temenos falls under the latter category.

The Concealed Push and Pull

Then there is the more elusive investor sentiment. Tech stock fervor is “on,” and Temenos can increase in price for no reason other than tech stock fever. If inflation worries, political news, or a sudden decline in otherwise unrelated industries put the market in a more cautious mood, Temenos could dip in stock price even when its quarterly results are solid.

Then there are changes in a particular sector that cannot be ignored. Temenos Share Price: A single new banking policy in Europe could force dozens of institutions to overhaul their entire systems. This is a possible advantage for Temenos. However, the price does not always respond immediately.

The Long Game is the Right Game

What I respect about Temenos is that the company plays the long game. Temenos Share Price: Temenos invests in research, continually improves its products, and incrementally expands into new regions, avoiding the temptation to pursue every short-term trend.

It may not generate headlines every single week, but this strategy over extended periods of time has a high likelihood of consistent advancement, which in turn attracts the attention of long-term investors who are interested in significant growth as opposed to spikes.

Analyst Impressions

Analysts like stability, and Temenos’s recurring software contracts provide that. Temenos Share Price. However, analysts also follow whether Temenos will be able to keep pace with its rivals in the pace of innovation.

An outstanding review can quadruple in the short term; however, real magic happens somewhere down the line when performance improves continuously for several consecutive years. The Things I’ve Picked Up From Following Temenos.

Having the ability to follow a stock for an extended period of time is a privilege. I, for instance, know that a single week of bad performance for Temenos is not the end of the world.

The Emotional To And Fro

We never really talk about the embarrassing things. Temenos Share Price: A 5 percent rise and fall will feel like the stock very much is alive, while a 5 percent dip makes the stock feel like it’s a dead weight.

With time, I have started to view the temenos share price as a novel. In this case, small fluctuations are the chapters, while as a whole the book is the share price.

Tips for People Who are just entering The Game.

I would encourage everyone to try to familiarize themselves with the entire organization before looking at the stock chart. Temenos is a perfect example; it is part of the segment that is undergoing substantial growth in digital banking and is unlikely to disappear anytime soon. Having faith in the business will make price fluctuations much easier to bear.

What Does The Future Hold For Temenos

Temenos is looking to further penetrate emerging markets, which poses a great deal of opportunities if local banks upgrade and modernize their infrastructure; however, guessing that the future of a corporation is risky business.

Fintech seems to be full of businesses fighting for customers. Despite the competition, Temenos receives recognition, which assists in overcoming the initial hurdles in the business.

Important Things To Follow

An expansion in the utilization of the internet and mobile banking increases the need for Temenos’s software.

Changes in laws or regulations that require banks to upgrade their systems.

Partnerships with other institutions will be beneficial to the global banks and will enable them to change their price in an instant.

The Wild Cards

Economic slowdowns, unanticipated currency changes, sudden technological failures, or unplanned tech changes can all pose risks. Because of all this, examining Temenos’s price is more of a timeless approach to identifying its trends.

Final Thoughts

Temenos is one of the companies that uses the infrastructure of other banks in the world. Temenos’s share price reflects how the investors view the prospects of financial tech in the next 5-10 years.

If you want to monitor Temenos, then you may want to focus on the entire market story for the company and not just the movements of the chart. The company may provide valuable insights and hints beyond the apparent numbers.